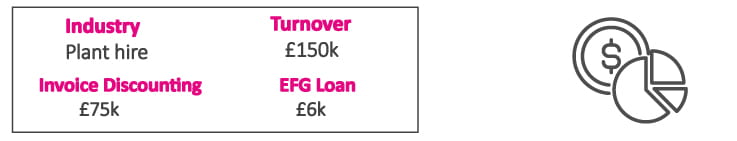

A plant hire business based in St Helens required an Invoice Finance facility and an EFG loan in order to avoid the business going into a CVL.

When promises to creditors of a company are broken or honoured with difficulty, it can often lead to administration or liquidation. These businesses in distress can often avoid insolvency by taking action before it is too late.

This plant hire business in this case was experiencing significant levels of distress and required the support of a funder who could help them in their time of need. By accessing a £75,000 Invoice Discounting facility, the business was able to avoid potential liquidation.

At Skipton Business Finance, we are not only interested in supporting thriving businesses. We are proud to support businesses who may not be performing to the standard that they want but have a clear vision for the future of their business.

Want to know more? Speak with us today and one of our Regional Directors can tell you more about this particular deal.

Find out more

At Skipton Business Finance, we offer the following types of Invoice Finance: